September 4, 2025

EU ETS Shipping Compliance: How to Prepare for the First EUA Deadline in 2025

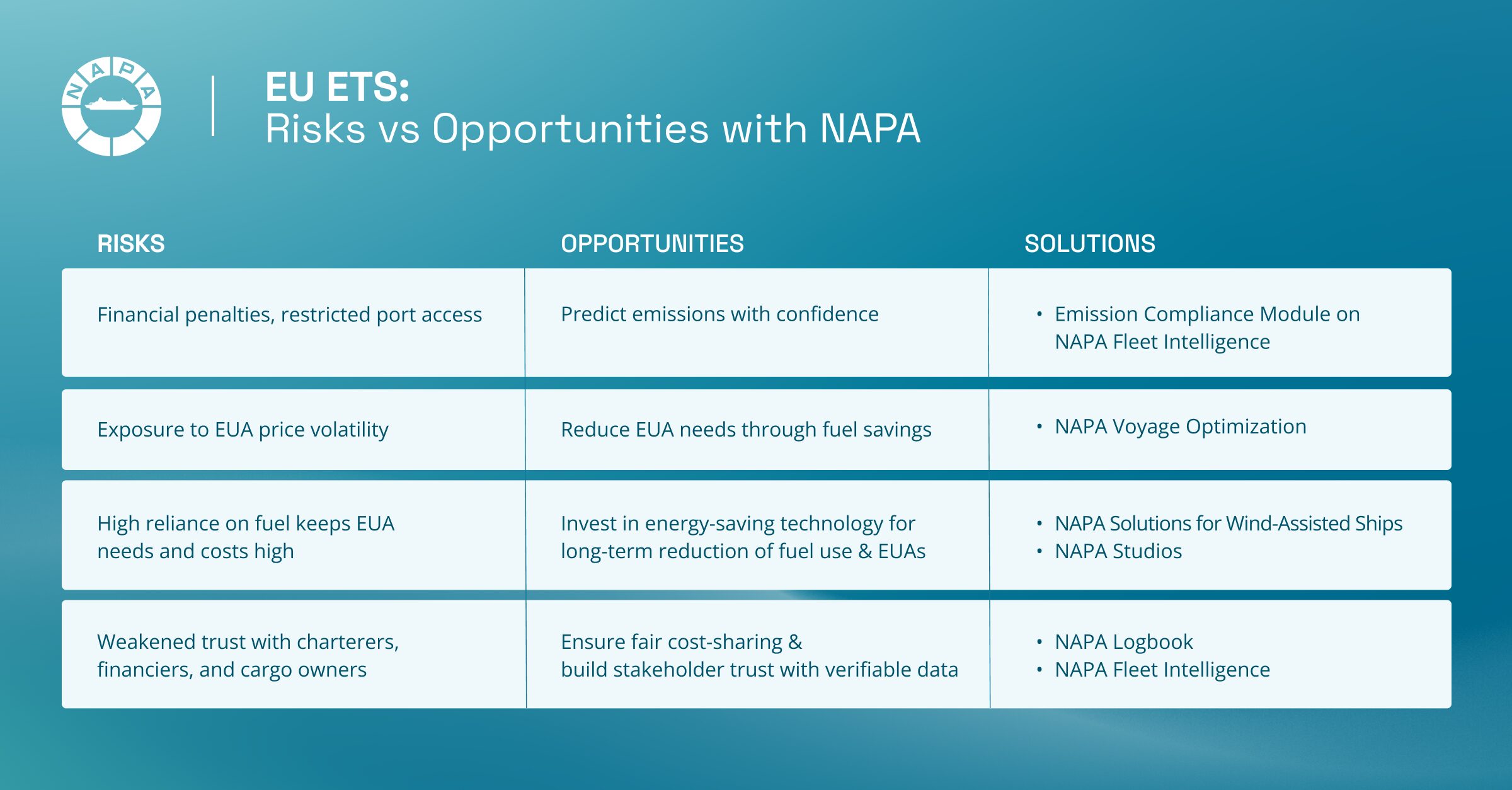

The EU Emissions Trading System (EU ETS) is quickly reshaping shipping, with the next major deadline – surrendering 40% of 2024 emissions allowances – falling on 30 September 2025. Many operators are still struggling with reporting and compliance, yet the stakes are rising fast: financial penalties, restricted port access, and losing competitive advantage. The potential risks make a data-driven EU ETS compliance strategy essential to turn regulation into opportunity.

While some in the industry have been enjoying a well-deserved summer break, there is no slowing down in the race to comply with the EU Emissions Trading System (EU ETS). The next compliance checkpoint is 30th September 2025, when operators must surrender 40% of their verified emissions for 2024 in the form of EU Allowances (EUAs). The clock is ticking!

While EU ETS was introduced in 2024, Lloyd’s List reported that less than 40% of the companies required to submit their verified emissions reports did so by the initial deadline of March 2025. More than half of the same survey’s respondents flagged that they viewed emissions reporting as a compliance burden, rather than an opportunity to explore EUA trading and gain a competitive advantage.

The compliance burden of EU ETS and the need for an EUA strategy

EU ETS has introduced an additional layer of complexity and administrative burden, particularly for small to medium-sized operators, to buy, manage, and surrender allowances. While the full picture of EU ETS compliance is captured in our practical guide to EU ETS, the 30th September deadline means that the prospect of operational consequences and financial penalties is an immediate threat.

A robust EUA strategy is, therefore, in sharp focus. Many companies have hired dedicated resources to handle these requirements, while some have subcontracted the task to other parties. Whether EU ETS compliance is managed in-house or outsourced, knowing the right time, price, and quantity of EUAs to buy can be a significant commercial advantage. Without accurate forecasts of emissions needs, operators risk overpaying, suffering from price volatility, or failing to comply.

This also makes EUA planning a cash flow management challenge. Buying too early can tie up capital, while waiting too long risks exposure to price spikes. Accurate forecasting with data-driven tools allows shipping companies to integrate EUA purchases into budgeting and financial planning, not just compliance reporting.

How NAPA’s data-driven solutions help operators cut costs and comply

The key to smarter EUA management is accurate, data-driven insights. With the right tools, operators can:

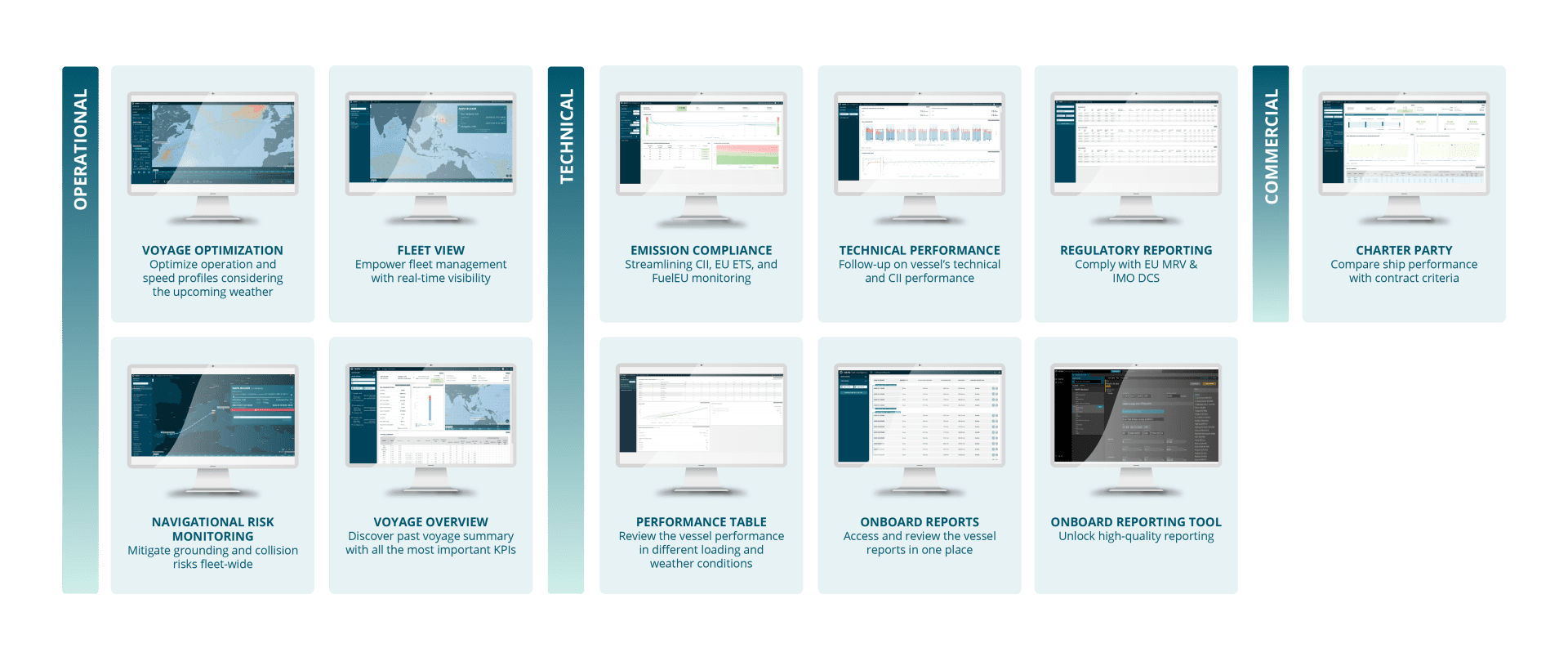

- Estimate EUA requirements with confidence using NAPA Emission Compliance Module within the NAPA Fleet Intelligence platform to calculate emissions at both vessel and fleet level, enabling operators to anticipate EUA demand.

- Reduce fuel consumption and the number of allowances needed. Tools like NAPA Voyage Optimization can help save up to 10% fuel consumption on some routes, with the exact impact depending on voyage length and conditions. For shorter intra-European voyages, the potential savings are typically lower, but still meaningful, especially when the price of EUAs is expected to be high. In parallel, investing in energy-saving technologies such as wind-assisted propulsion can deliver further long-term reductions in fuel use and EUAs. Learn more about NAPA Solutions for Wind-Assisted Ships.

- Ensure fair cost-sharing between ship owners and charterers using NAPA Logbook and NAPA Fleet Intelligence modules for ship performance, digital record-keeping, and optimization, which provides a transparent, neutral platform to calculate emissions for each voyage, reducing the potential for disputes and uncertainty.

Build stakeholder trust by providing verifiable, third-party data on emissions and fuel use. This transparency not only strengthens owner–charterer relationships but also supports reporting for financiers, insurers, and cargo owners demanding proof of compliance.

Turning EU ETS compliance into a competitive advantage with NAPA

EU ETS will continue to expand, and so will obligations under it. The phased implementation means that while only 40% of emissions must be covered in 2024, this will rise to 70% in 2025, and 100% from 2026 onward (50% for voyages to and from non-EU ports). Alongside EU ETS sits its tougher FuelEU Maritime counterpart (explore NAPA FuelEU Compliance Tool), and in 2025 alone, these EU regulations will add an estimated $6.1 billion to industry costs. Fast forward to 2028, with the International Maritime Organization’s potential Global Fuel Intensity measure in effect, and a typical vessel running on HFO could dial up almost $380,000 in carbon costs. If operators continue to operate in ‘business as usual’ mode, the industry could be facing a $50 billion carbon bill by 2030. For cargo owners and charterers, this is a multi-billion-dollar challenge that will influence trade patterns, freight rates, and fuel choice.

The financial, operational, and reputational implications of EU ETS make one thing clear: a robust understanding of emissions and fuel consumption data is no longer optional – it’s business critical. With NAPA Fleet Intelligence and the latest solutions for ship performance and decarbonization, operators can turn compliance into an opportunity: reducing costs, optimizing fleet operations, and fostering stronger collaboration across the value chain.

NAPA Fleet Intelligence for smarter, safer, and more sustainable shipping

Interested in:

- How to enhance your fleet’s operational efficiency to improve competitiveness?

- How to comply with the latest regulations, such as the EU ETS, CII, and FuelEU?

- How to reduce fuel consumption and foster more sustainable operations?